Pass-through vendors selling major consortium bank account data don’t want you to know the limits of their coverage

If your business relies on rapid online transactions, chances are it also relies on major bank account validation services. It would seem to make sense – when it comes to collective U.S. and Canadian bank data, bigger is better. Right?

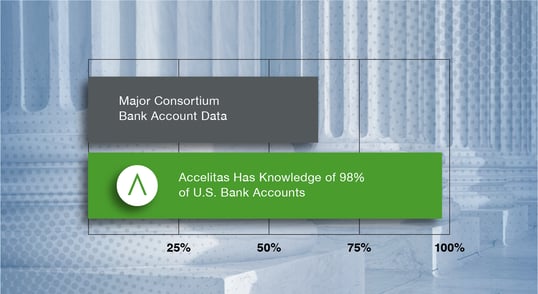

Not exactly. For starters, the big validation services come up short when it comes to coverage — as much as 30% short. The commercially viable options for account validation also tend to be costly, time consuming, and cause potential customers to abandon the process. And if you have questions or need a customized solution — good luck. That’s not how pass-through vendors do business.

That’s where Ai Verify/Bank Data from Accelitas comes in. The non-credentialed bank account validation service delivers unmatched coverage of US and Canadian bank accounts, along with real-time data updates and confirmation to improve ACH success rates, reduce returns, and mitigate risk while staying compliant with the Nacha verification rules.

We also eliminated the long-term contracts and set-up fees, but we don’t think you’ll miss them.

Bottom line: put Ai Verify/Bank Data to the test and you can lift coverage by 30%.

No wonder traditional services want to avoid the comparison.

Accelitas invites you to see for yourself.

Click below to arrange a no-cost proof-of-concept test.