On May 31, 2018, Accelitas CEO Greg Cote delivered a talk “The Good, the Bad, and Your Data” - highlighting Identity Intelligence at the CU Direct DRIVE Conference in Grapevine, Texas. Here’s the second post - of a two part blog series - where Greg’s explains how to increase your customers with AI and Alternative Data.

Leveraging AI to identify more good customers, while reducing the bad ones.

In our last post, we highlighted three major challenges that will impact the growth and profitability of the financial services industry over the next few years. To meet these challenges and achieve success requires more than just keeping out the bad guys. It requires leveraging new AI techniques for identifying more good guys and seamlessly converting them into customers.

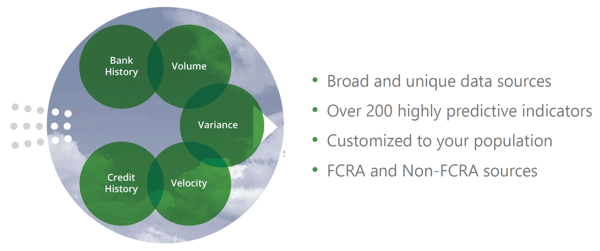

Accomplishing this requires bringing together two key elements—broad alternative data sources and powerful, AI analytics—to help deliver accurate and predictive insights about the identity, creditworthiness, preferences, and habits of customers.

So how do we achieve this analytical breakthrough?

Identity Intelligence outperforms traditional account screening because of two things:

- The breadth of the data itself; and

- The type of analytics applied to the data.

Broad Data Sources and AI to the Rescue

Let’s start with the data. Much of the raw data available has existed before, but it was distributed across too many services and not collected in a single service for analysis.

So the first requirement for building Identity Intelligence is selecting the right—and broadest—data, including alternative sources. This is especially important if you’re trying to do business with Generation Z and financially underserved consumers. With these thin-file and no-file consumers, you need to have the broadest, most relevant data possible, so you have some chance of finding the signals you need to make profitable business decisions.

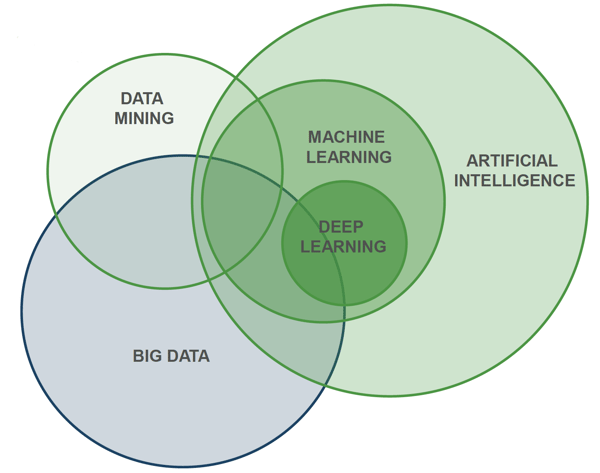

The other thing you need is more advanced analytics. This is where Artificial Intelligence (AI) comes in, including advanced techniques such as machine learning and deep learning.

By applying AI techniques, it’s possible to discover overlooked but critically predictive signals in data. It’s also possible to create services that leverage machine learning techniques to become increasingly accurate and predictive over time.

Now if you’ve already looked into using AI techniques for lending decisions, you may have had someone on your regulatory team tell you that you can’t use black-box techniques, because if you do, you won’t be able interpret the results. You’ll know that a loan was accepted or rejected, but you won’t know why.

But if you take a multi-disciplinary approach, you can leverage the power of AI while achieving results that are both predictive and interpretable. (Read about the benefits of applying cross-disciplinary approaches to AI.)

The Predictive Power of Identity Intelligence

You might be surprised about how predictive some of this non-credit data can be. We recently ran a study on 10,000 customer accounts for small-dollar loans, evaluating the performance of this portfolio in terms of First Payment Default (FPD) and profit. The portfolio overall had a 14% FPD rate. The average loan was $150.

Analyzing this data revealed some interesting insights:

- Mazda 3 owners are 4X more profitable than the median.

- Large money center bank customers are 27% more likely to default than the median.

- Consumers who have an interest in Craft & Hobbies are 1.3X more profitable than the median.

This is just a small sample of some of the results. Of course, this will not be true in all cases, but it demonstrates how bringing together broad and unique data sources and leveraging predictive analytics can help you increase your Identity Intelligence. The benefits of this approach have helped our clients:

- grow profitable business, even from accounts they had previously rejected

- reduce FPD rates by as much as 40%

- reduce fraud and customer churn

- achieve an ROI of 30:1 or higher.

These are impressive results in any economy. As we head into a likely downturn, they are results that might make the difference between growth and stagnation for a lender.

Accelitas and Identity Intelligence

At Accelitas, we’re putting together these two elements—broad and alternative data sources and powerful, predictive analytics—to help our customers use Identity Intelligence to identify more good customers.

Our Accelerated Insight Platform® enables companies to:

- streamline account opening for all channels, including mobile, online, and brick-and-mortar

- identify and grow profitable accounts with confidence

- reduce fraud and customer churn

- re-evaluate rejected accounts for overlooked indications of creditworthiness

With challenging times on the horizon, now is the time to increase your profitability by implementing a new approach that identifies more good customers, while reducing the bad ones. The right data, powered by AI and the Accelerated Insight Platform, enables you do to both.

To learn more about how our predictive analytics enables organizations to streamline mobile account opening, open more profitable accounts, and verify high-risk transactions, download our 'Predictive Analytics Solution Brief' by clicking the button below.