Real-time mobile onboarding is a critical feature missing from all too many mobile apps in financial services.

Today’s banking apps allow consumer to perform basic tasks such as depositing checks, transferring funds, and querying account balances—tasks that are possible only once an account has been opened. But few institutions allow consumers to open a new account from a mobile device and be fully onboarded, ready for handling funds. Mobile apps in other parts of the financial services market, such as person-to-person payments and online lending, also lack support for real-time onboarding.

Some apps take consumers halfway. They enable consumers enter to some account data, such as contact information, when applying for a new account from a mobile device. But then they require consumers to visit branches or storefronts to verify their identities and finish the onboarding process.

Some institutions even require consumers to start the application process all over again when they step into a branch supposedly simply to sign the final papers. For these institutions, the onboarding feature of their mobile app is little more than a marketing hook.

But real-time mobile onboarding can be, and should be, much more.

Why Real-Time Mobile Onboarding Is Important

There are excellent reasons for banks and other financial services organizations to offer a complete solution for real-time mobile onboarding:

- Consumers, especially Millennials and other tech-savvy users, now expect to be able to handle all aspects of their relationship with a brand on a mobile device. If an app does not offer real-time mobile onboarding, many of these consumers will seek out apps from competitors that do.

- About 10% of unbanked consumers rely on their smartphones for all their Internet access. Without real-time mobile onboarding, these consumers may never open an account with an institution. Some of these consumers are wary of visiting branches, where they might be turned down in front of other people. Mobile account opening enables them to apply for accounts at any time, wherever they feel comfortable.

- By 2020, about 25% of accounts are expected to be onboarded through mobile devices. Offering this capability now gives institutions the ability to grow accounts with mobile-savvy consumers.

Real-time Mobile Onboarding Requirements

Once an institution decides to offer mobile onboarding, it needs to ensure that its mobile app meets a substantial list of requirements related to business operations, compliance, security, and user experience.

Here are seven critical requirements for real-time mobile onboarding:

- Read and analyze identity documents (IDs) to authenticate consumers.

Financial services organizations are legally required to verify the identities of applicants when onboarding accounts. Authenticating identity documents (IDs) such as driver’s licenses is an excellent way to meet this requirement. Consumers should be able to take a picture of their IDs with smartphones and tablets and submit those pictures so that the IDs can be authenticated and the identities of the applicants verified. - Use auto-form-fill to streamline processes, reduce errors, and deliver a fast, frictionless customer experience.

In addition to aiding with identify verification, IDs include basic information such as name and address information that must be collected for creating customer records, printing checks and debit and credit cards, and delivering printed statements and other communications. IDs also include information such as signature specimens and photos that financial organizations may want to collect for use when issuing cards such as debit cards or credit cards.

A complete solution for real-time mobile onboarding should collect all this information from the front and back of an ID. Name and address information can be used to automatically fill-in form data for the application. The photo and signature information can be read and stored for future use. Using auto-form-fill to collect textual information saves consumers from having to type the information on mobile devices. Auto-form-fill accelerates the application process, improves the customer experience, and reduces the chances of typos corrupting applicant data. It helps organizations deliver the fast, frictionless experience that consumers increasingly expect. - Auto-correct old address data.

About 30% of consumers are carrying IDs with old address data. The real-time mobile onboarding app should automatically update address information, so the financial organization has the correct mailing address for contacting the consumer. - Apply advanced security techniques to detect fraud in real time.

Fake IDs can be easily purchased on the Internet. (A 2009 study found that 32% of college seniors in the U.S. owned fake IDs.) To detect these fakes, the mobile app should ensure that the card data is correct and that card security features such as barcodes, holograms, and Machine Readable Zones (MRZs) are rendered correctly and encoded correctly and consistently. Security analysis should also consider features such as wear and tear. (To learn about Accelitas' patent for ID authentication based on wear, read our press release.) - Create a token for tracking ID use across locations and transactions.

Tokenization is the use of a mathematical string to uniquely identify an object such as an ID. By tokenizing an ID during onboarding, organizations accelerate ID authentication in future transactions. Tokenization also provides an added measure of security, since mobile apps can rely on tokenization to ensure they are accepting IDs they have already analyzed closely. - Perform account segmentation in real time.

Along with collecting and verifying applicant data, a real-time mobile onboarding app should also analyze the applicant data to perform account segmentation. The app should be able to make product decisions or recommendations in real time. For example, some consumers might be interested in accounts that require higher balances in exchange for lower fees. Recommending this type of account during the onboarding process helps ensure that institutions are delivering the right product to the right consumer from Day 1. - Complete the onboarding process, so consumers do not need to visit branches to complete applications.

The app should make it possible for consumers to complete onboarding on a mobile device without having to visit a branch or other location later to sign papers. When consumers are told they have to visit a branch to complete the onboarding process, many of them give up. When they lose their enthusiasm, the organization loses a potential customer. Completing the onboarding process in real time through a mobile app solves this problem with abandonment. Delivering a fast, frictionless, and complete mobile onboarding process helps organizations win more business from tech-savvy consumers.

The Accelitas Solution for Real-time Mobile Onboarding

Accelitas offers three real-time services that together provide a complete solution for real-time mobile onboarding. The services are available through our Accelerated Insight® platform for Customer Identity Intelligence.

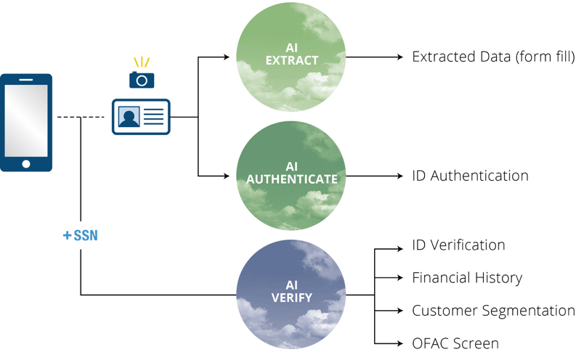

We offer a patented identity document authentication solution designed specifically to address the challenges of authenticating and onboarding consumers on mobile devices. Featuring two web services, AI Extract for auto-form-fill and AI Authenticate for real-time ID authentication, the solution provides a fast, reliable way of streamlining account-opening and transaction verification to deliver a frictionless customer experience.

Our AI Verify service provides instant identity verification and product guidance for new applicants, enabling organizations to grow revenue while supporting financial inclusion. Built on Accelitas' proprietary discovery system, AI Verify enables organizations to better differentiate customers, grow revenues, prevent fraud, and comply with KYC/CIP, Red Flags, and OFAC.

Together, these services return data-driven insights in seconds. Accelitas makes account opening fast and easy for consumers, and safe and predictable for financial institutions, hospitality companies, retailers, and other organizations interested in opening mobile accounts.

To learn more about the Accelitas solution for mobile account opening, please call +1 (415) 842-7700 or write to sales@accelitas.com.