This blog post by DSi CEO Greg Cote originally appeared on LinkedIn.

If this year’s LendIt USA conference in New York City is any indication, we’re at the beginning of a new era in Financial Services. We’re moving beyond Big Data into a new era of Digital Transformation in which Machine Learning radically improve data analysis, enabling new types of products, services, and businesses.

Allow me to explain.

Last Decade’s Digital Goldmine

The era of Big Data hit the mainstream media around 2005. That’s the year when Yahoo! built its first iteration of the Hadoop data store and Roger Mougalas from O’Reilly Media used the term “Big Data” to refer to data sets so large they were unmanageable with traditional tools. Big Data had its roots, though, in the late 1990’s with OLAP data stores.

Banks have long recognized that they have access to more data on their customers than most other businesses. They collect data from online banking, Web advertising, branch visits, call centers and other sources, always mindful of the opportunity to learn more about customers and market trends.

In 1998, at the large regional bank where I worked, we struggled to recognize a life event represented by a customer’s unusually large deposit in time to do anything about it. Banks were sitting on a digital gold mine. They knew it, but they weren’t sure yet how to leverage it into actionable information.

In the Big Data era, organizations began heavily investing in new IT solutions (such as data warehouses, integration layers, and Hadoop) for consolidating, storing and analyzing this vast quantity of data. When they analyzed data from across the silos they had built, they began to get a clearer, more holistic view of their customer’s behaviors and needs for the first time. From the board level down, Big Data was and still is recognized as a strategic initiative worthy of investment and attention.

But data analytics is about to get a new technological boost that makes the Big Data analysis of a few years ago seem like a local commuter rail compared to a bullet train.

Enter Machine Learning

What’s new now is the use of Machine Learning to accelerate analysis, to make analysis progressively smarter and more effective, and to automate analysis that years ago could only have been achieved by a roomful of hardworking, highly paid analysts or data scientists poring over data and delivering results in months or weeks instead of hours or seconds.

Startling advances in Machine Learning are showing up all kinds of business and applied analysis, ranging from genomics to sports betting to finding your best customers, the Keepers.

We’re now able to find signals in what previously would have been only a vast sea of noise. You can now use broad generic data sources to predict probable customer actions when on the surface there is no apparent connection between the data and the action. And in financial services, finding that signal—that connection hidden in the data—can be critical for broadening financial access to previously underserved consumers who have been shut out of traditional financial products such as DDA accounts and credit cards for many years. It can also be critical for reducing fraud in new channels such as mobile banking.

Because Machine Learning is enabling banks, credit unions, online lenders, and other types of financial organizations to take on wholly new products and operations, I believe it’s appropriate to call this what it is: a Digital Transformation of financial services, not just a creeping optimization thanks to faster processors, tweaked algorithms, and ever more ingeniously design NoSQL data stores.

There will be many beneficiaries of this new transformation:

- Financial institutions will finally be able to accurately anticipate their customer’s life events and financing needs by offering them relevant, helpful products ahead of time.

- FinTech companies and the institutions they partner with will be able to enter new markets and grow profits with manageable risk.

- More consumers—especially unbanked consumers such as Millennials and recent immigrants—will be able to gain access to affordable and reliable financial services.

- Small businesses will gain quick access to credit that would not have been readily available under older and slower methods of underwriting.

These are truly exciting transformations.

Broadening Access with Constraining Risk

At DSi, we’re excited about this new era and its possibilities, especially for underserved consumers and the financial organizations that serve them. We think Machine Learning is just the technology to enable this critical industry to accelerate growth while containing risk.

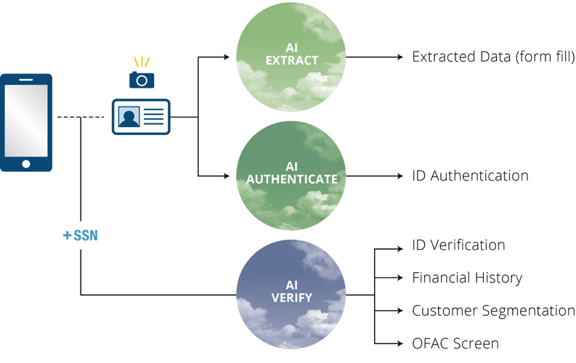

Our contribution to this area is centered on a critical moment in the customer journey: account-screening and onboarding, whether in branches and offices or on mobile devices.

Our patented Document Insight ID authentication solution, with its AI Extract and AI Authenticate services, uses Machine Learning to become increasingly astute at detecting fake IDs (which as you probably know, have become increasingly sophisticated and subtle) and determining if the token of the identity document that we issued at onboarding is the same as the one we see in each subsequent transaction. Document Insight leverages Machine Learning to getting better over time at both difficult tasks.

Through ongoing exposure to an organization’s customer base, our Accelerated Insight account-screening solution can be refined to deliver ever more accurate predictions regarding an applicant’s likely profitability or probability of a life event, as well as indications of which product would best meet the applicant's needs. Out of the box, Accelerated Insight delivers higher match rates than traditional account screening services due to our advanced clustering algorithms. Adding progressive fine-tuning makes it even more adept at delivering fast, predictive responses for financial organizations.

(If you’d like to learn more about our data analytics, please contact us. We'd be happy to tell you what we’ve been up to.)

What excites you most about the use Machine Learning in financial services? How do you see the Digital Transformation of financial services playing out for you? Please post a comment and let me know.