Offering and Advertising Lower-risk Products

The Consumer Financial Protection Bureau (CFPB) is urging banks and credit unions to offer lower-risk products to financially underserved consumers. In a press release issued in February 2016 and in an earlier letter to the country’s largest 25 banks, the CFPB urged bankers to offer and promote these accounts:

- Offer lower-risk products:

Today the CFPB is encouraging banks and credit unions to offer products that are designed not to authorize overdrafts and that do not charge overdraft fees…. In a recent CFPB review of the top retail banking websites, the CFPB found nearly half do not appear to offer any deposit account that ensures consumers can’t overspend. Such a product would give consumers an opportunity to choose an account that helps them avoid overdrafting. - Advertise the lower-risk products:

The CFPB is concerned that even when companies have these accounts available, consumers don’t know about them. So the CFPB is also urging banks and credit unions to feature such products prominently in their marketing efforts, their online and in-store checking account menus, and during sales consultations.

We applaud this idea. At DSi, we’re committed to the goal of supporting financial inclusion, which includes making useful, affordable financial products more easily available to financially underserved consumers.

Let’s examine what’s required in delivering these products to consumers, including consumers who have little or no history with traditional financial institutions such as banks and credit unions.

Requirements for Delivering Lower-Risk Products to Underserved Consumers

Requirements for Regulatory Compliance and Identity Verification

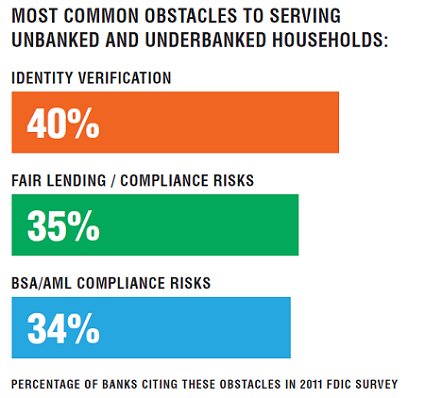

When the FDIC surveyed banks several years ago and asked them about their biggest obstacles to serving financially underserved consumers, banks reported that the biggest obstacles lay in the area of regulatory compliance.

The most common response? Forty percent of banks said that identity verification was their greatest obstacle. They were having difficulty verifying the identities of consumers who had been outside the traditional world of banking. These consumers included:

- unbanked applicants, who had neither a checking nor a savings account

- underbanked consumers, who had one of these accounts but who primarily relied on alternative financial services (AFS) products such as check-cashing services and pre-paid cards for managing their money

Even when providing a lower-risk product to a consumer, banks and credit unions must still comply with KYC requirements. Aside from regulatory requirements, they usually want to verify identities anyway, simply as a matter of mitigating risk.

The challenge for these institutions is that about 30% of American consumers are invisible to traditional account-screening services. Of this 30%, about one third are unbanked and two thirds are underbanked.Clearly, not opening an account for an underserved applicant, or opening it and then closing it several days later when KYC data cannot be confirmed, does not serve the purpose of the CFPB’s directive.

Until institutions can verify the identities of these consumers, their good intentions for offering lower-risk products will be frustrated by a lack of identity data.

Requirements for Product Segmentation Analysis

Data is lacking, too, about which applicants should be offered lower-risk products and which should be offered traditional products and possibly even cross-sold on additional products such as lines of credit. In some cases, the most appropriate product for an underbanked applicant may be a traditional DDA account, because the applicant’s financial status is stable and suitable for growing business with the institution.

Branch staff and online account opening applications need insights about product segmentation in real time in order to recommend the right type of product at account opening. They also need insights about when cross-selling other products, such as pre-paid cards or credit cards, may be appropriate.

The Bottom Line: The Missing Link Is Data Analysis

Banks and credit unions actually need two types of data analysis at account opening:

- Identity verification for reducing risk and complying with KYC requirements

- Financial stability analysis and product segmentation guidance, so the applicants are offered the products that are most appropriate for their situations.

How Accelerated Insight Account Screening Helps Institutions Realize the CFPB’s Vision for Lower-Risk Products

Accelerated Insight is a real-time account-screening service from DSi that provides critical data-driven insights missing from traditional account-screening services.

To support the CFPB’s mission of financial inclusion and lower-risk accounts, Accelerated Insight:

- Matches KYC/CIP data for a much higher percentage of applicants than traditional account-screening services. Instead of matching just 70% of applicants, Accelerated Insight matches 93% or more, enabling financial institutions to say “yes” to more account applicants.

- Delivers real-time product selection guidance that helps branch staff and online services recommend the most appropriate product to applicants at account opening. Accelerated Insight identifies stable, profitable customers on Day 1, so banks can recommend the right products and even cross-sell based on data analytics rather than hunches.

Learn More

To learn more about how Accelerated Insight helps institutions meet the needs of underserved customers, read our white paper, Growing Profitable Accounts with Underserved Consumers.

To learn more about how Accelerated Insight helps institutions meet the needs of underserved customers, read our white paper, Growing Profitable Accounts with Underserved Consumers.

Or contact us at sales@dragnetsolutions.com or +1 (415) 842-7700 ext. 1.