This post is an excerpt of an article by Dragnet Solutions CEO Greg Cote for the WIB Directors Digest newsletter. The full article is available on the WIB site.

Sometimes in business a feature or function dismissed as tactical or merely technical proves itself to be strategic — a vital tool for organizations to grow their wealth and preserve their marketshare. I would like to argue that real-time account segmentation has become such a strategic capability today.

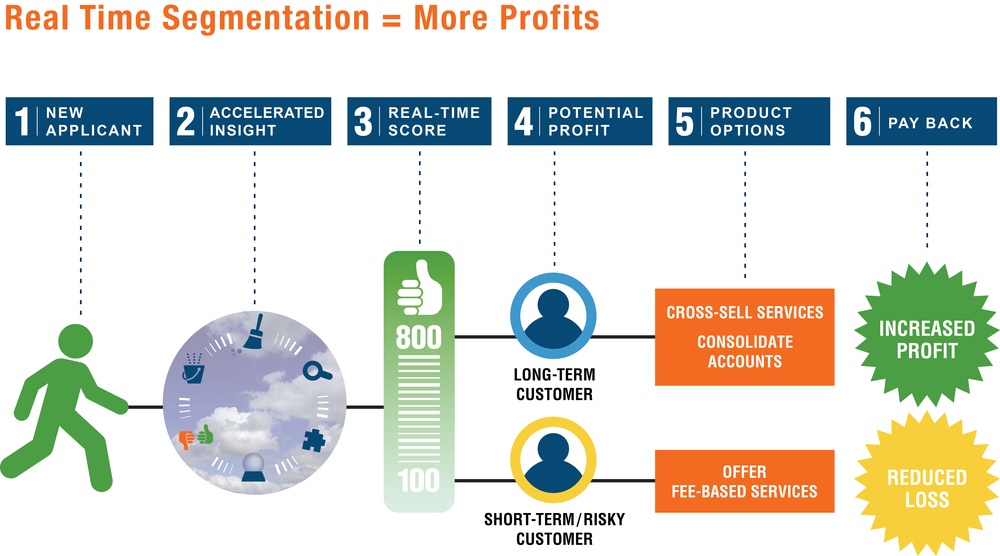

By “real-time account segmentation,” I mean the ability, at account opening, to identify the probable profit or risk associated with a new customer and to know when it’s prudent to aggressively cross-sell to that customer to maximize profits and long-term growth. To understand why this capability has become essential and strategic, let’s quickly review a few facts.

Interest rates are low, and most bankers expect them to remain low. Non-interest income for most banks has been hovering at around 2 percent since the recession.

At the same time, regulations (such as Dodd-Frank) and regulatory costs have been increasing.

At many institutions, applicants either become loyal, long-term customers who eventually sign up for multiple products, or they charge off or for some other reason close their account within a matter of months.

Operating costs are rising too, often in spite of well-intentioned internal initiatives aimed at efficiency. Why are costs rising? In part, it’s because customers expect many more features from their accounts. Whether they have DDA accounts, loans or credit cards, customers expect omnichannel, or at least multi-channel, access and features. To provide that multi-channel support requires new technology (mobile platforms, integrated customer support, etc.). Each of those new technologies involves new vendors, new contracts and new fees that become part of a bank’s operating budget. Unfortunately, the competitive environment has made passing these new fees along to customers almost impossible.

Put all this together and you have institutions scrambling to support new features, new products and new channels, and incurring new costs and facing new regulatory hurdles.

In this environment, what can banks leverage to grow revenue? One obvious answer is, their own customer base – the business that is already walking in the door. Of course, banks need to be prudent, because every customer poses the risk of increased operating costs. In a multi-channel world, a typical customer brings typical multi-channel costs. Account acquisition and onboarding usually costs a bank about $150 per DDA customer. Annual account maintenance can run $250-$450, but those traditional costs may rise as an institution rolls out new features such as remote deposit capture. So, getting more customers is good, so long as their lifetime revenues outweigh their lifetime costs.

At many institutions, customers tend to fall into one of two groups. They either become loyal, long-term customers who eventually sign up for multiple products, or they charge off or for some other reason close their account within a matter of months. To maximize profits while minimizing costs, banks need to be able to distinguish the customers who will be loyal and profitable from the customers who will be transient and costly.

Telling one type of customer from the other isn’t as easy as it sounds. Hence the need for real-time account segmentation. New Big Data technology gives a bank access to relevant public records and other data sources and enables real-time decision-making at the moment of account opening. By segmenting accounts when they are opened, branch associates can make profitable decisions about which products to offer and cross-sell.

For example, a risky customer might be given a DDA account without overdraft protection or checks. A transient customer might be offered a fee structure that recoups the acquisition cost more quickly. A less risky, more financially stable customer might be given a full-featured account with checks, overdraft protection, and reduced fees. In addition, the branch associate opening the accounts would be notified to cross-sell to the more financially stable customer immediately. This type of information helps the banker properly match the products offered to the customer at account inception and maximize expected profits on a customer by customer basis.

To pursue this strategy, some banks may have to re-think their approach to account screening.

Account-screening technology that was put in place around the time of the USA PATRIOT Act helps banks comply with regulations, but fails to get them the real-time analysis they need to segment customers confidentially at account opening. Some banks will need to complement a bare-bones, “CIP-only” screening solution with a more rich and insightful analytical approach that enables branches to systematically make the kind of profit-or-loss decisions described above.

In today’s environment of low fees and high costs, making profitable decisions like these isn’t a luxury. It’s an essential business strategy.

The banking industry is not the wireless business where customers sign 2-year contracts providing certainty around whether the acquisition cost will be recouped by the carrier. Real-time, customer specific guidance can help banks improve the certainty of profits by better predicting how long a customer will remain. The banks that pursue this strategy will reap the rewards of a larger, more stable customer base that enables the bank to afford and offer the new sophisticated services that were creating the dilemma in the first place. It all starts with real-time insight and real-time segmentation.

Learn more about Accelerated Insight.